Exploring Integrated Assurance for a Comprehensive Risk Management Approach

- Benoit Lescot

- Jun 9, 2025

- 2 min read

Transform how your organization manages risk by aligning your second and third lines of defense. Eliminate redundant work, enhance visibility, and deliver a unified view of risk to leadership through integrated assurance.

The Challenge of Siloed Assurance

Understanding the Three Lines of Defense

The three lines model establishes clear responsibilities for risk management across your organization. While this framework provides structure, communication barriers between these lines often result in inefficiencies, duplicated efforts, and incomplete risk coverage.

What Is Integrated Assurance?

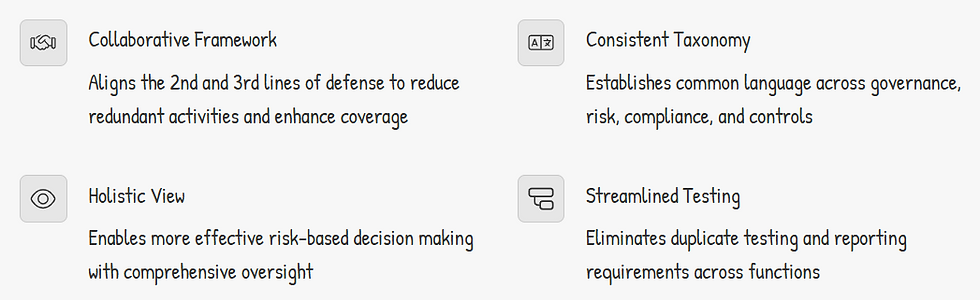

Key Benefits of Integration

Organizations implementing integrated assurance report significant returns on their investment. Beyond cost savings, integration delivers strategic advantages through improved decision-making based on more accurate and comprehensive risk information.

The Four Pillars of Integrated Assurance

Governance Clear accountability structures, well-defined policies, and effective oversight mechanisms ensure consistent application of risk management practices throughout the organization. | Risk Management Systematic processes for identifying, assessing, and responding to risks using consistent methodologies across all business functions and defense lines. | Compliance Comprehensive approach incorporating prevention, detection, and response mechanisms to ensure adherence to both external regulations and internal policies. | Internal Controls Effective control framework operating within established risk boundaries, with clear ownership and assessment responsibilities across defense lines |

These four pillars provide the foundation for successful integrated assurance implementation. When aligned and working in harmony, they create a robust framework that enhances risk management effectiveness while reducing operational friction.

Building Your Integrated Assurance Roadmap

Step 1: Building Your Integrated Assurance Roadmap

Current State Assessment

Evaluate existing assurance activities, identify gaps, overlaps, and inefficiencies across all three lines of defense. Document pain points and quantify resource impacts.

Step 2: Framework Development

Create common risk language, taxonomy, and assessment methodologies. Establish governance structures and clear roles and responsibilities for integration.

Step 3: Implementation Planning

Develop technology enablement strategies, data sharing protocols, and coordination mechanisms for assurance activities across functions.

Step 4: Execution & Refinement

Implement integration initiatives, measure effectiveness, gather feedback, and continuously improve the integrated assurance model.

Technology Enablers for Integration

The right technology infrastructure is critical for effective integration. Modern GRC platforms enable seamless information sharing, coordinated workflows, and comprehensive reporting that brings assurance functions together while enhancing overall effectiveness.

Common Challenges and Solutions

Organizational Resistance to Cross-Functional Collaboration

Inconsistent Methodologies Between Assurance Providers

Competing Priorities and Resource Constraints

Technology Limitations and Data Quality Issues

Case Study: Integrated Assurance in Action

A global financial services organization implemented integrated assurance across their risk, compliance, and audit functions. By coordinating assurance planning, they achieved a 35% efficiency gain and $1.2M in annual cost savings from eliminated duplicate testing. The board reported significantly higher confidence in risk coverage, and the organization accelerated their ESG compliance initiatives through their newly coordinated approach.

Comments